As Petco’s IPO draws near, questions linger about the company’s ability to clear the hurdles that have hindered its growth in the past. Since Petco was last a public company back in 2006, the pet industry has become increasingly focused on premium products delivered via e-commerce channels. Has Petco positioned itself to thrive in this dynamic space? In today’s post, we analyze several components of Petco’s performance, including how it has fared versus e-commerce competition, whether it is able to draw new customers or capitalize on increased spend from returning customers, and how favorable its demographics are. These datapoints are key for analysis of any company, and may provide insights for current competitors or any businesses considering expanding into the pet industry.

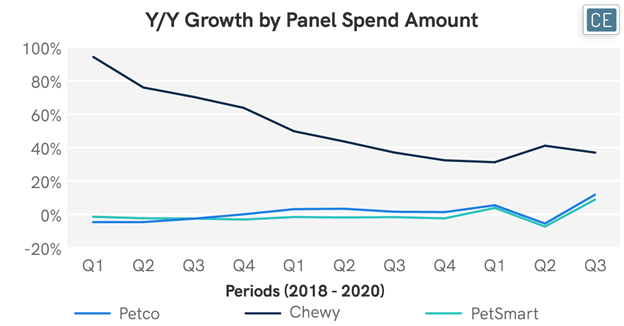

A key obstacle to Petco’s growth has been the rise of e-commerce competitors. Like other retail customers, pet owners are becoming increasingly interested in avoiding trips to big box stores in favor of shopping online. As such, large e-commerce players like Chewy have grown rapidly, while Petco’s growth has remained relatively stagnant.

Petco Spend Growth

To compound matters, Petco’s sluggish growth has been accompanied by an inability to acquire new customers or drive additional value from its current base. In every month since the beginning of 2019, less than 20% of Petco’s customers have been shoppers visiting the brand for the first time. Without a large influx of new consumers, it should become more important to try to bolster growth by deriving more value from returning customers. However, it does not seem like Petco has been able to capitalize on customer loyalty either. Spend among longtime consumers is remarkably similar to that of returning customers who more recently joined the brand’s base.

Petco Customer Profile

Note: New customers defined as those shopping at Petco for the first time since 4/7/2017

Note: First transaction cohort defined by period in which customers made first purchase at Petco since 4/7/2017

Despite static growth and bleak opportunities for improvement, there are still reasons for optimism. Although Petco has fared poorly in its ability to bring in new customers, its acquisition efforts are more effective than its top competitors. Additionally, Petco boasts a unique customer base that tends to be younger and have higher incomes than the bases of its peers. If Petco focuses on this key customer segment and leverages its proficiency in obtaining new customers, the company can position itself for success.

Petco Customer Acquisition Opportunities

Note: New customers defined as those shopping at Petco for the first time since 4/7/2017

Note: Those making at least one purchase in calendar 2019

Note: Calendar 2019

Gaining a better understanding of the dynamic pet industry is just one example of the numerous capabilities that can be leveraged from CE Vision. The platform provides historical spending patterns for numerous brands, allowing companies to compare growth trends within and across industries. Additionally, CE Vision can classify brands’ customer bases as new or repeat customers. Comparing this data with cohort spending patterns allows companies to evaluate the effectiveness of brands’ customer acquisition and retention efforts. Finally, CE Vision allows users to analyze demographic trends among brands’ customers, helping uncover potentially untapped markets.