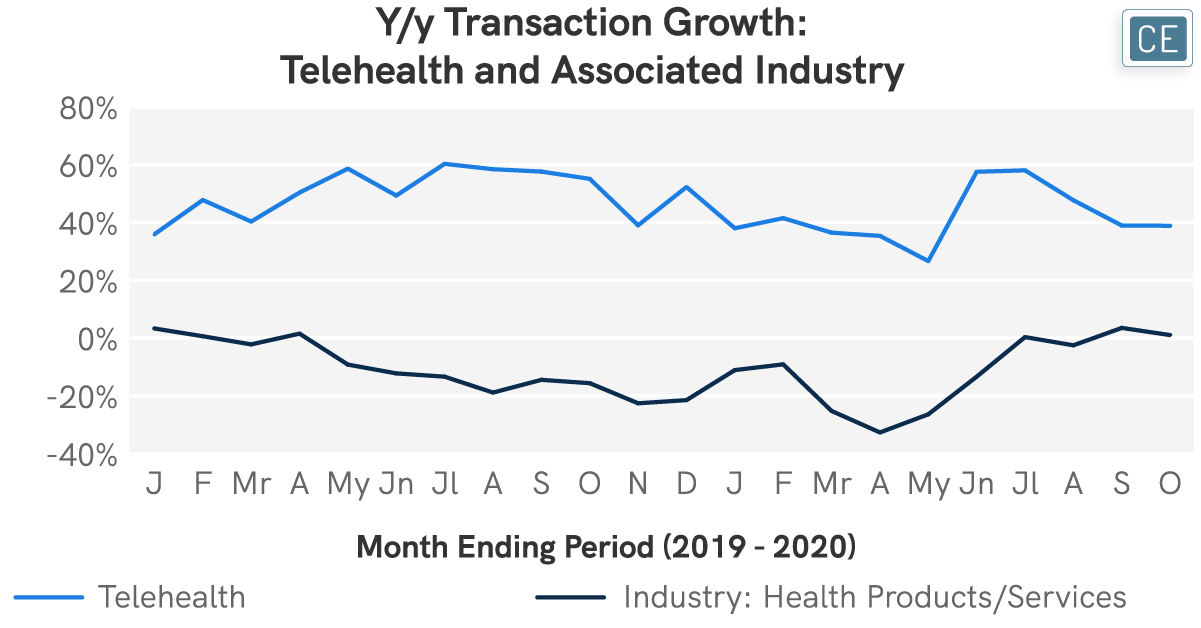

At a time when health and disease are at the forefront of news reports and have taken over most people’s daily lives, it is almost counterintuitive the extent to which there are reports of people letting their health suffer because they are afraid to see an in-person doctor. Enter the telehealth sector, already experiencing strong growth pre-pandemic, with COVID-19 allowing it to maintain that strength. But is that strength sustainable? Are all companies in the sector seeing the same lift? And how might larger demographic trends shift that?

Subindustry Growth

One key question for these companies is staying power. Consumers are finding the idea of telehealth compelling, but are they satisfied enough to come back? Up until the COVID-19 pandemic, just as many people were trying telehealth services as coming back to them, with transactions from new shoppers about equal to transactions from repeat shoppers. This trend started to diverge in May as those driven to telehealth services in March and April came back for additional services into the summer. In September and October, two-thirds of telehealth transactions were from repeat shoppers.

New vs. Repeat Shoppers

Although Telehealth is nascent, early leaders are emerging. Nurx has consistently held top market share at an average of ~40% of transactions over the past twelve months. Teladoc was a strong player pre-pandemic, but saw transaction share decline dramatically in April as PlushCare and Talkspace made a stronger push. Doctor On Demand had strong market share with over a quarter of transactions at the beginning of 2019, but that share has been declining steadily and has remained in the single digits since April.

Share isn’t everything though – strength in a single market segment can also be just as powerful. Among the top Telehealth brands, each has a different positioning. Looking at each brand’s exposure to age group vs. the overall subindustry, Nurx has 1.8x as large a percentage of 18-24 year olds (the younger skew not surprising given their focus on birth control), PlushCare and Doctor on Demand skew older with 1.7x as large a percentage of 55-64 year olds and 65+ year olds (respectively), Teladoc also skews older but less dramatically with 1.5x as large a percentage of 65+ year olds, and Talkspace is more balanced but still has 1.3x as large a percentage of 25-34 year olds as the Telehealth subindustry.

Market Share

Exposure

Emerging spaces in new business format may seem attractive, and CE Vision gives companies the opportunity to evaluate these new trends. The platform allows for several different types of new vs. repeat shopper analysis in order to see if the emerging space is benefitting mostly from “let’s try it” or beginning to take hold as a part of customers’ lives. It also allows users to see which brands have been taking the lead in emerging categories and which demographics are driving brand growth.